10 Best Fraud Detection Software Shortlist

Here's my pick of the 10 best software from the 27 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

In today's digital age, fraud detection software is your shield against deceptive transactions. Utilizing machine learning, these tools swiftly discern patterns that may escape human scrutiny. They streamline authentication processes, ensuring only legitimate users gain access. Providers have crafted these pains: reducing the risk of financial loss due to fraud and eliminating the time-consuming task of manual fraud detection. Integrating such software can significantly boost your operational security while saving time and resources.

What Is A Fraud Detection Software?

Fraud detection software is a technological solution designed to monitor and analyze transactions, behaviors, and patterns to identify and prevent deceptive activities. Primarily utilized by businesses, financial institutions, and e-commerce platforms, these tools safeguard against unauthorized access, financial scams, and other malicious intents, ensuring that only legitimate activities proceed and helping to maintain the integrity and security of operations.

Best Fraud Detection Software Summary

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for full chargeback coverage | Not available | Pricing upon request | Website | |

| 2 | Best for enterprise-level fraud management | Not available | Pricing upon request. | Website | |

| 3 | Best for online order screening services | Not available | From $20/user/month (min 5 seats). | Website | |

| 4 | Best for ecommerce fraud prevention research | Not available | From $10/user/month (min 5 seats) + $49 base fee per month. | Website | |

| 5 | Best for secure money transfer validation | Not available | From $20/user/month + $75 base fee per month. | Website | |

| 6 | Best for identity verification via AI | Not available | Website | ||

| 7 | Best for identity and transaction validation | Not available | From $12/user/month (billed annually) + $50 base fee per month. | Website | |

| 8 | Best for chargeback prevention | Free demo | Pricing upon request | Website | |

| 9 | Best for real-time bot protection | 30-day free trial | From $4,190/month | Website | |

| 10 | Best for IP-based fraud detection | Not available | From $15/user/month (billed annually). | Website |

-

Docker

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6 -

Pulumi

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

GitHub Actions

Visit Website

Best Fraud Detection Software Reviews

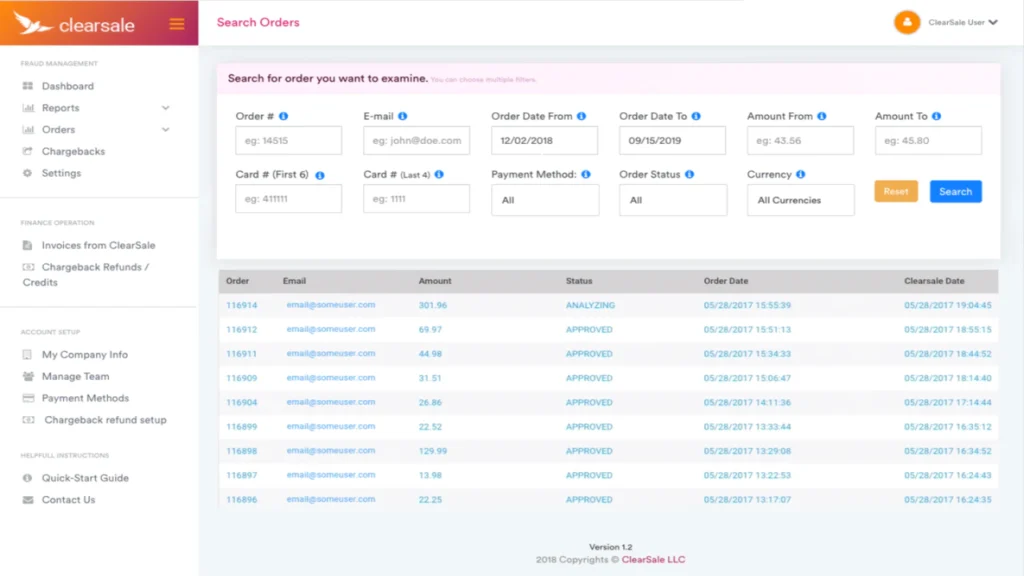

ClearSale is a dynamic fraud prevention solution that significantly emphasizes providing businesses with full chargeback coverage. In an era where online transactions can be susceptible to fraud, having a tool that offers comprehensive protection against chargebacks is essential, which is where ClearSale's prowess comes into play.

Why I Picked ClearSale: I've concluded that ClearSale is the best tool for this list. It offers full chargeback coverage, a rare guarantee in the market. Based on my analysis, I chose ClearSale as the top choice for 'Best for full chargeback coverage' due to its focused approach to reducing payment processing risks and keeping businesses protected.

Standout features & integrations:

ClearSale offers a deep risk assessment mechanism, meticulously analyzing transactions to ensure they're genuine. Furthermore, they incorporate social media data into their evaluations, providing an extra layer of verification crucial in today's interconnected world. ClearSale works effortlessly with major e-commerce platforms and payment processing systems for integrations, ensuring businesses can continue their operations without friction.

Pros and cons

Pros:

- Compatibility with a wide range of e-commerce platforms and payment processing systems.

- Incorporation of social media data into transaction verifications provides a contemporary layer of scrutiny.

- Comprehensive chargeback protection ensures businesses remain financially secure.

Cons:

- The depth of transaction scrutiny might lead to occasional false positives.

- Social media data reliance may raise privacy concerns for some users.

- The annual billing model might not be favorable for all businesses.

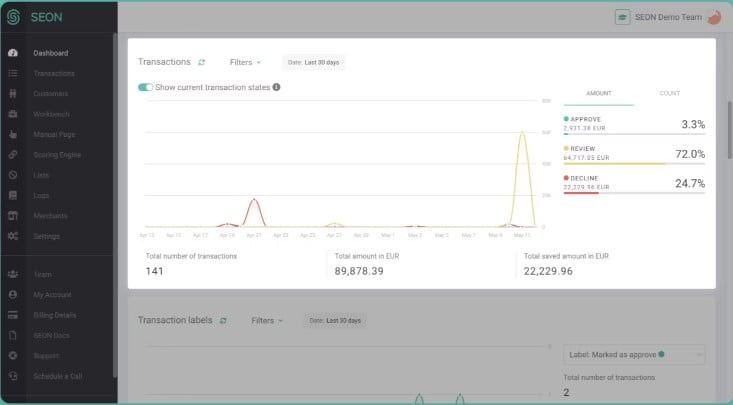

SEON. Fraud Fighters is a specialized platform that provides enterprise-level solutions to manage and combat financial fraud. This platform offers companies an effective fraud detection solution tailored to their unique operational needs by leveraging advanced data analysis techniques.

Why I Picked SEON. Fraud Fighters: SEON's Fraud Fighters stood out to me because of their enterprise-grade solutions and data analysis expertise. I chose this platform for its advanced tools for large-scale businesses, making it the perfect fit for enterprise-level fraud management.

Standout features & integrations:

SEON. Fraud Fighters boasts features like real-time data analysis, which aids in the instant detection of suspicious activities. Its modules are designed to provide deep insights, allowing businesses to understand and counteract financial fraud more effectively. Regarding integrations, the platform smoothly connects with major enterprise-level systems, streamlining its implementation into existing workflows.

Pros and cons

Pros:

- Offers deep insights into financial fraud patterns.

- Designed specifically for enterprise-level operations.

- Advanced real-time data analysis capabilities.

Cons:

- Initial setup might require technical expertise.

- Might be overkill for smaller operations.

- Lack of transparent pricing can be a hurdle for some businesses.

Eye4Fraud offers a dedicated solution tailored towards online order screening, ensuring businesses can operate without fearing fraudulent transactions. With the surge in identity fraud and online malicious activities, their services stand paramount in filtering genuine orders from the potentially harmful ones.

Why I Picked Eye4Fraud: I chose Eye4Fraud as my online order screening tool for its thorough approach to screening and authenticating orders, using unique metrics that other tools may miss. After comparing options, I concluded that its comprehensive evaluation, particularly in examining IP addresses, makes it the top choice for online order screening services.

Standout features & integrations:

A standout feature of Eye4Fraud is its dynamic analysis system, which checks traditional data points and data points but also evaluates patterns, behaviors, and the integrity of IP addresses. Moreover, its algorithm adapts to new fraudulent trends, ensuring businesses are always ahead. As for integrations, Eye4Fraud offers compatibility with most e-commerce platforms, payment gateways, and CRM systems, allowing for an integrated approach in tackling identity fraud.

Pros and cons

Pros:

- Integrations with major e-commerce and payment platforms

- Adaptable algorithms that keep up with evolving fraudulent trends

- Comprehensive order screening that includes behavioral analysis and ip address verification

Cons:

- Requires a minimum of five seats, potentially excluding very small businesses.

- The depth of analysis can sometimes slow down the verification process

- Might be on the pricier side for small businesses

NoFraud is an end-to-end solution dedicated to helping e-commerce businesses battle the persistent threat of fraud. Its strength resides in its comprehensive research tools, making it the go-to platform for e-commerce fraud prevention research.

Why I Picked NoFraud: Choosing the right tool often involves comparing multiple options and judging their efficiency. After much deliberation, NoFraud stood out for its emphasis on research, a crucial component for e-commerce platforms. Its distinctiveness lies in its in-depth approach to fraud detection. Given the vast e-commerce landscape, having a tool that puts research at its core justifies why NoFraud is 'Best for ecommerce fraud prevention research.'

Standout features & integrations:

NoFraud boasts advanced workflows that enable businesses to streamline their fraud prevention processes. It also provides robust AML (Anti-Money Laundering) tools, crucial for companies to maintain compliance and operate securely. When it comes to integrations, NoFraud doesn't disappoint. It's compatible with most major e-commerce platforms, ensuring businesses have a unified system to fend off potential threats.

Pros and cons

Pros:

- Strong AML features enhancing security compliance

- Advanced workflows that facilitate streamlined operations

- Comprehensive research-oriented fraud prevention tools

Cons:

- Integrations, while extensive, might miss out on some niche platforms.

- Some users may desire more customization options

- Might have a steeper learning curve for beginners

CertifID offers specialized tools that validate money transfers, providing an added layer of security for financial transactions. Given the rise in fraudulent activities and chargebacks, it's imperative for businesses to use such solutions, making CertifID a go-to choice for secure money transfer validation.

Why I Picked CertifID: In selecting a reliable tool, CertifID rose to prominence in my considerations. I judged its approach based on the number of data points it uses to validate each transaction. Comparing its features and the opinions of several experts, I determined that CertifID stands out for its robust chargeback management system. I firmly believe it's 'Best for secure money transfer validation,' especially for businesses that regularly handle significant financial transactions.

Standout features & integrations:

CertifID's strength lies in its comprehensive validation system that utilizes multiple data points to ensure the authenticity of each money transfer. The tool is particularly praised for its advanced chargeback management features that effectively help businesses tackle transaction declines. As for integrations, CertifID fits into most checkout processes, complementing existing payment gateways and enhancing security.

Pros and cons

Pros:

- Smooth integration with common checkout platforms

- Effective chargeback management system to handle declines

- Extensive validation process using multiple data points

Cons:

- Some users may find the interface less intuitive than competitors' platforms.

- Not the cheapest solution available in the market

- Might require some initial training for new users

In the world of identity verification, Onfido has positioned itself as a leader, leveraging AI-driven methods to ensure users are who they say they are. Its strength lies in its adept use of artificial intelligence, making it the top choice for businesses seeking top-notch identity validation, a pivotal reason it's championed as the 'Best for identity verification via AI.'

Why I Picked Onfido: During my deep dive into fraud detection tools, Onfido stood out significantly due to its AI-powered identity verification techniques. When weighing my options and judging the efficiency and accuracy of different platforms, I determined that Onfido had a distinctive edge. Its prowess in utilizing AI for identity checks solidified its spot as the 'Best for identity verification via AI,' especially vital for retailers and others in industries where identity assurance is paramount.

Standout features & integrations:

Onfido brings robust risk management tools that enable businesses to gauge the legitimacy of their users swiftly. Beyond just identity checks, its risk scoring feature offers an additional layer of protection, grading user profiles based on a range of risk parameters. Integrations? Onfido ensures compatibility with various platforms, viral CRM systems, and payment gateways to ensure a cohesive operation.

Pros and cons

Pros:

- Broad integrations, especially for retailers

- Comprehensive risk scoring offers layered protection

- AI-driven identity verification is top-notch

Cons:

- Not the most beginner-friendly interface.

- AI-based tools require periodic reviews for best results

- Might be a steep learning curve for some users

TruValidate emerges as a robust platform for authenticating identities and ensuring genuine transactions. Employing cutting-edge technology provides businesses can confidently validate both parties in a transaction, underpinning its status as the top tool for identity and transaction validation.

Why I Picked TruValidate: In the process of comparing various tools, TruValidate constantly made its mark. I chose it due to its unique functionality that adeptly identifies fraud patterns, an essential feature in the modern digital age. Its singular focus on validating identities and verifying the authenticity of transactions makes it distinct. Based on its capabilities and my comparative analysis, TruValidate is the 'Best for identity and transaction validation.'

Standout features & integrations:

TruValidate is known for its dynamic functionality, which swiftly identifies and acts on fraud patterns, ensuring businesses are always ahead of fraudsters. This functionality is pivotal in minimizing fraud risk and safeguarding businesses and their customers. As for integrations, TruValidate meshes well with several leading financial software platforms, granting businesses the flexibility to embed it into their existing systems.

Pros and cons

Pros:

- Integrations with top financial platforms

- Efficient in reducing fraud risk, thereby offering better protection

- Dynamic functionality that readily spots fraud patterns

Cons:

- Some businesses might want more extensive reporting tools.

- Pricing might be on the higher side for small businesses

- Might require initial training to utilize its full potential

Riskified takes charge in the battle against payment fraud, focusing intently on thwarting chargebacks that plague businesses. Their system addresses the pesky problem of payment reversals and directly enhances the customer experience by ensuring secure transactions, hence the label 'Best for chargeback prevention.'

Why I Picked Riskified: In my search for tools, I found Riskified. Their strong emphasis on preventing chargebacks caught my attention. It was crucial to find a solution that understood the seriousness of chargebacks caused by fraud. Riskified's commitment and successful approaches to reducing chargebacks make it clear why it is the top choice for chargeback prevention. This software protects both businesses and their customers against payment fraud.

Standout features & integrations:

Riskified shines with robust algorithms that detect and prevent chargebacks before they occur. The system's efficiency lies in its real-time analysis, swiftly verifying credit card transactions and flagging potential fraud. Integrations are abundant, accommodating major e-commerce platforms and payment gateways, ensuring businesses can combat fraudsters across all transaction avenues.

Pros and cons

Pros:

- Enhances customer experience by preventing fraud-induced disruptions

- Comprehensive credit card transaction verification

- Effective real-time chargeback detection

Cons:

- Some reports of false positives, though infrequent.

- Businesses new to e-commerce might find its depth overwhelming

- Might require some time to understand the complete suite of tools

DataDome offers businesses protection against malicious bots by providing real-time detection and mitigation solutions. With the growing threat of online fraud, DataDome's expertise in bot protection becomes paramount, solidifying its position as the premier choice for real-time bot defense.

Why I Picked DataDome: When I was determining which tool to include on this list, DataDome consistently stood out. I chose it for its sterling reputation and its unique approach to case management and onboarding, which differentiates it from other tools. With the rise in online fraud and bots becoming increasingly sophisticated, I concluded that DataDome is indeed the 'Best for real-time bot protection.'

Standout features & integrations:

DataDome has advanced bot detection and website/application protection features. Their case management system helps businesses respond to potential threats quickly and efficiently. DataDome integrates smoothly with various web platforms and applications for a seamless implementation process without disruptions.

Pros and cons

Pros:

- Versatile integrations with popular web platforms and applications

- Efficient case management system to handle threats

- Real-time bot detection capability with actionable insights

Cons:

- Certain advanced features may have a steeper learning curve.

- The interface could be more intuitive for non-technical users

- Might be considered pricey for startups or small businesses

IPQualityScore offers specialized tools focusing on IP-based fraud detection to ensure secure online transactions and user interactions. In the digital era, where maintaining the integrity of a digital identity is crucial, IPQualityScore provides the necessary fraud monitoring tools to safeguard businesses from malicious entities.

Why I Picked IPQualityScore: I chose IPQualityScore as the best fraud prevention solution because of its deep understanding of IP-based fraud detection and its focus on protecting users' digital identities. Its extensive fraud monitoring capabilities make it the ideal choice for IP-based fraud detection, earning it the title of 'Best for IP-based fraud detection' in my opinion.

Standout features & integrations:

One of IPQualityScore's significant features is its robust database that offers real-time IP analysis, helping businesses instantly identify and block potential threats. Furthermore, its machine learning algorithms continuously learn and adapt to new fraud patterns, enhancing its efficiency. In terms of integrations, IPQualityScore easily integrates with major eCommerce platforms, CRM systems, and other software solutions, ensuring a holistic fraud prevention solution.

Pros and cons

Pros:

- Wide range of integrations with popular platforms

- Continuous learning through machine algorithms to adapt to emerging fraud patterns

- In-depth real-time IP analysis for accurate fraud detection

Cons:

- Additional features might come at a higher cost.

- Some users may experience a learning curve initially

- Annual billing may not be suitable for all businesses

Other Noteworthy Fraud Detection Software

Below is a list of additional fraud detection software that I shortlisted, but did not make it to the top 10. Definitely worth checking them out.

- Signifyd

For ecommerce fraud protection guarantee

- Sift

For digital trust and safety platform integration

- Nethone

Good for Know Your User (KYU) profiling

- Kount

Good for AI-driven fraud detection

- NICE Actimize Xceed

Good for autonomous financial crime management

- Ocrolus

Good for automating financial document analysis

- Prove

Good for phone-centric identity authentication

- iDenfy

Good for identity verification in real-time

- MediaGuard

Good for advertising fraud prevention

- Fingerprint

Good for device-based user recognition

- F5 Distributed Cloud Bot Defense

Good for advanced bot protection on cloud

- Bolt

Good for unified checkout and fraud protection

- GeoComply

Good for precise geolocation compliance

- Pipl

Good for deep web identity data sourcing

- SAP Business Integrity Screening

Good for integrating fraud management into business processes

- Arkose Lab

Good for robust anti-fraud orchestration

- Forter

Good for comprehensive fraud prevention suite

Other Fraud Detection Software-Related Reviews

Selection Criteria For Choosing Fraud Detection Software

Having had the opportunity to delve deep into the world of fraud prevention software, I've put several tools to the test. While I've evaluated dozens of these tools, in this case, I was particularly keen on their ability to provide robust protection without compromising the user experience. After extensive research and hands-on testing, here are the critical criteria I believe one should consider when selecting the ideal fraud prevention software.

Core Functionality

- Real-time Analysis: The tool should be able to analyze transactions or actions in real time, identifying potential fraud instantly.

- Multilayered Security: A combination of identity verification, device recognition, and behavioral analytics.

- Chargeback Protection: The ability to safeguard businesses from chargebacks that can be costly and harm reputations.

- Global Coverage: Ensure that the software protects multiple countries and regions.

Key Features

- Dynamic Risk Profiling: Dynamically assigning risk scores based on user behavior, transaction details, and other relevant parameters.

- Device Fingerprinting: Identifying and tracking devices that access a platform, helping to catch repeat offenders or link multiple fraudulent activities.

- Machine Learning Capabilities: This enables the system to learn from previous fraud attempts, making its detection methods more accurate.

- Integration Options: Easy integration with existing systems or platforms without extensive modifications.

- Customizable Rule Sets: Allowing businesses to set up their own rules and thresholds for suspicious behavior.

Usability

- Intuitive Dashboards: For this kind of tool, dashboards should give clear insights at a glance, with easy-to-understand graphics that detail fraud attempts, blocked transactions, and more.

- Efficient Alert System: Instant notifications for suspicious activities, allowing immediate action.

- Role-Based Access: Given the sensitive nature of fraud data, the software should enable businesses to set who can access what data. A sales rep might only need to see transaction details, while a security officer might need access to everything.

- Comprehensive Onboarding: Given the complexity of some fraud prevention systems, a detailed training program or a well-documented learning library is essential for new users.

When it comes to fraud prevention, one size does not fit all. Understanding your business's specific needs and referencing the above criteria should pave the way to finding a solution that provides both robust protection and an absolute user experience.

Most Common Questions Regarding Fraud Detection Software (FAQs)

What are the benefits of using fraud detection software?

Using fraud detection software offers numerous advantages, including:

- Real-time Fraud Detection: These tools can identify and block fraudulent activities instantly as they occur.

- Reduced Chargebacks: With better fraud detection, businesses can substantially reduce the number of chargebacks they face, saving money and preserving their reputation.

- Enhanced Security: They often use multiple layers of security protocols, making them robust against various fraud techniques.

- Scalability: As a business grows, these tools can scale accordingly, ensuring continued, comprehensive protection.

- Operational Efficiency: Automating fraud checks means faster transaction approvals and a smoother user experience without compromising security.

How much does fraud detection software typically cost?

The cost of fraud detection software varies widely based on its features, the number of transactions it handles, and its target audience (small businesses vs. large enterprises). Some might charge a flat monthly fee, while others may base their pricing on the volume of transactions.

What are the typical pricing models for these tools?

There are several pricing models, including:

- Per Transaction: A fee is charged for each transaction processed.

- Monthly Subscription: A set fee charged monthly, often with tiered pricing based on features or the number of transactions.

- Tiered Pricing: Costs increase as you access more features or handle more transactions.

- Freemium: Basic features are free, but advanced or more significant transaction volumes come at a cost.

What's the usual price range for these tools?

Fraud detection software can range from as low as $20/month for essential services suitable for small businesses to several thousand dollars a month for enterprise-level solutions with a comprehensive feature set.

Which is the cheapest fraud detection software?

The exact answer might vary based on current market offerings, but as of the last update, some tools like “Fingerprint” offer competitive pricing for small to medium-sized businesses.

Which software is the most expensive?

Enterprise-level solutions, such as “SEON. Fraud Fighters,” tend to be at the higher end of the pricing spectrum because of their extensive features and scalability.

Are there any free fraud detection tools available?

Some tools offer freemium models where basic features are available for free, but advanced features come at a cost. Always check the tool’s official website for the most up-to-date information on their pricing and offerings.

Is the cost of fraud detection software worth the investment?

Absolutely. The initial investment in a reliable fraud detection tool can save businesses significant amounts in the long run by preventing fraudulent transactions, reducing chargebacks, and ensuring an experience for genuine users. The peace of mind and security it provides often outweigh the costs.

Summary

Selecting the best fraud detection software is a pivotal decision to safeguard a business from potential threats and financial losses. Throughout this guide, we've provided insights into various software options, their unique selling propositions, and the criteria that matter most when selecting. Whether a small business owner or heading an enterprise, understanding your specific needs and matching them to the software capabilities is crucial.

Key Takeaways:

- Core Functionality Matters: Beyond the bells and whistles, ensure the software genuinely addresses your primary concerns, be it data analysis, user behavior monitoring, or financial fraud prevention.

- Usability is as Essential as Features: The best fraud detection software integrates effortlessly into your existing systems, offers an intuitive interface, and provides robust customer support for extensive adaptation.

- Consider the Total Cost: Pricing models for fraud detection software can vary widely. Always factor in setup fees, minimum seat requirements, and potential additional costs when determining the best value for your investment.

What Do You Think?

We're always eager to hear from our readers to ensure our guide remains comprehensive and up-to-date. If you've come across a fraud detection software that has impressed you and believe it deserves a spot on our list, please let us know. Your insights and recommendations are invaluable in keeping this resource relevant and helpful for everyone.